Euronews Business investigate what the OECD projects in its most recent examination of the major global patterns and prospects for the following two years.

More grounded than-anticipated Gross domestic product growth in 2023 is going to dial back as more tight monetary circumstances, powerless exchange growth and lower business and shopper certainty keeps on negatively affecting global economies, the Association for Economic Co-activity and Advancement’s (OECD) has said.

In its most recent economic standpoint report, the OECD projects in its two times yearly examination of the major global patterns and prospects for the following two years, a delicate arriving for cutting edge economies.

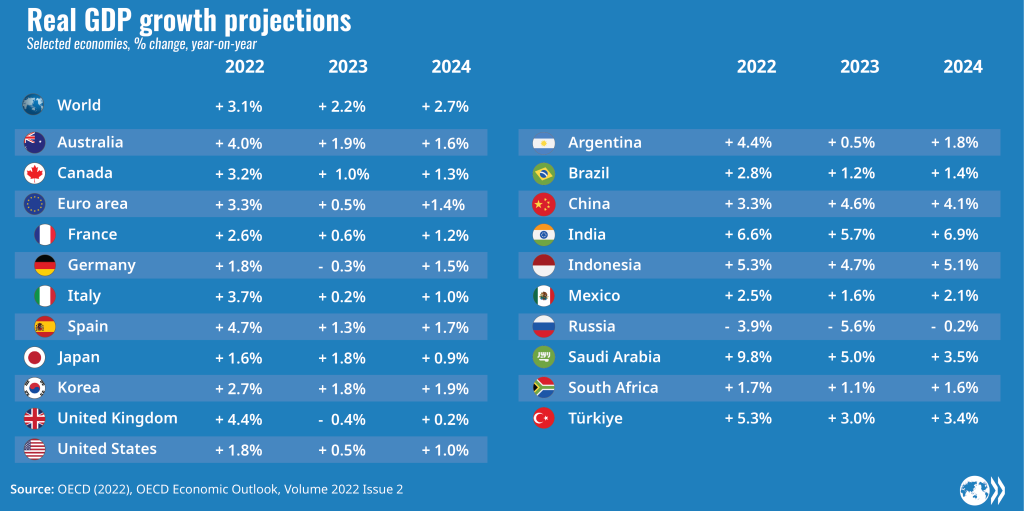

Globally, it predicts growth will to simplicity to 2.7% in 2024, from 2.9% this, prior year getting to 3% in 2025, because of genuine pay growth recuperation and lower financing costs.

Previously, be that as it may, the OECD had gauge a lull of growth due to feeble PMI readings (review showing business feeling) in many significant economies, easing back credit growth and determinedly low degrees of purchaser certainty.

The speed of growth is lopsided

High level economies face commonly more slow growth than developing business sectors, and Europe’s exhibition is lingering behind North America and significant Asian economies.

Europe, where the economy is firmly impacted by exorbitant loan fees and where higher energy costs delay wages, faces an especially troublesome way to recuperate completely.

Paradoxically, Gross domestic product growth has held up better in the US and numerous other item delivering economies. The developing business sector and creating economies have all in all kept up with growth rates near those seen preceding the pandemic.

As indicated by the OECD, the eurozone can anticipate 0.5% yearly Gross domestic product growth throughout the previous three months of 2023. The coalition’s Gross domestic product is supposed to enlarge by 0.6% this year, trailed by 0.9% in 2024 and 1.5% in 2025 separately.

Growth is hauled down in Europe, where the significance of bank finance is somewhat high and the strain on wages from higher energy costs has been major areas of strength for especially. Looking forward, notwithstanding, utilization is supposed to areas of strength for be to tight work showcases and expanding genuine livelihoods as expansion is easing back.

Then again, the gauge likewise assesses that the full effect of more tight financial approach in the coalition is still to show up and movement might be hit surprisingly firmly.

Expansion is facilitating yet stays a worry

Title expansion has fallen wherever throughout the last year, principally impacted by a moderate degree of energy costs in the main portion of 2023.

Nonetheless, cuts by key OPEC+ economies and supply disturbances in the oil market brought about higher oil costs since June. This joined with the vulnerability because of rising international pressures is presently obfuscating expansion possibilities.

Center expansion is assessed to have fallen beneath 3% in the G7 economies all in all in the second from last quarter of 2023, contrasted with the past quarter, dialing back from more than 4.25% during the principal half of the year.

As per the OECD, expansion in the Eurozone is going to ease back to 2.9% one year from now following 5.5% this year and will settle at 2.3% in 2025.

The ECB’s objective of 2% isn’t a reality for an additional two years, the viewpoint signals 2.1% just for the finish of the inspected period; the most recent three months of 2025.

Joblessness stays low

Across the OECD nations, joblessness rates stay low with a normal 5.1% for both 2024 and 2025.

The rate is figure to increment in the US, the Unified Realm, Canada and Australia. In any case, in Japan and the eurozone joblessness is supposed to stay low and near current degrees of 6.5%.

Workforce growth has major areas of strength for stayed, there is a lull in yearly business growth, lower opening, and at times a gentle upswing in joblessness rates.

Right now, close work markets keep supporting hidden utilization. Nonetheless, lined up with this, confidential venture is projected to be hauled somewhere near exorbitant loan costs.